Selling your business is a life-changing event, representing the culmination of years and, in some cases, generations of hard work and investment.

The decision of when to sell can be daunting. Many unknowns and variables exist that can overwhelm even the most decisive and seasoned business owners. After all, making a major business decision without a full understanding of the different potential outcomes can be a recipe for disaster.

So, why not undertake a planning process that sets you up for success in what likely represents the largest and most meaningful transaction in your lifetime?

Taking the time up front to build a more informed perspective about the market, your business, and transaction alternatives from a reputable investment banker is a smart first step to achieving your ultimate succession objectives.

This can be accomplished through a Strategic Assessment, which often is performed months or even years in advance of starting the process of selling your business.

How does a Strategic Assessment help?

The short answer is it provides an objective view of how potential buyers or investors will value your business. It is a current evaluation of your business through the lens of a potential buyer. It takes an informed look at your financial results, growth prospects, operations, customers, and corporate structure and recommends various transaction alternatives, as well as a suggested timeline to achieve your ultimate transaction objectives.

What Is included In A Strategic Assessment?

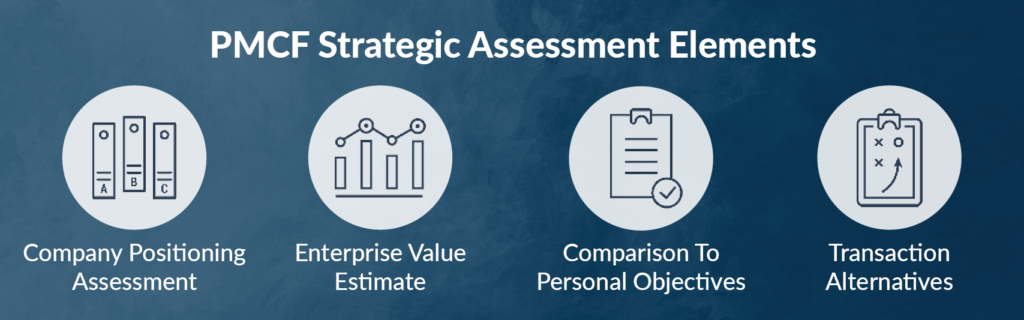

Every business is built differently, and PMCF’s tailored and thorough Strategic Assessment process is constructed with that in mind. This comprehensive tool examines a business holistically, focusing on financial results, growth prospects, operations, customers, and organizational structure. Primary elements of a Strategic Assessment include:

- Company Positioning Assessment

- Enterprise Value Estimate

- Comparison To Personal Objectives

- Transaction Alternatives

The Impact Of A Strategic Assessment

1. Prepares Your Company For The Scrutiny Of Capital Investors

The due diligence process during a sale transaction is extensive and time consuming. A Strategic Assessment helps you prepare for a transaction by utilizing much of the same information investors will request.

Importantly, working through this exercise in advance of a transaction (i) identifies potential pitfalls so they can be avoided when the actual sale process commences, (ii) streamlines the information gathering process for you and your team, and (iii) creates better formatting and packaging of data to support the desired outcome.

2. Identifies Value Attributes And Constraints Of The Business

Identifying a company’s top value attributes for buyers is a critical differentiator during a sale transaction. Knowing your company’s strengths and weaknesses is paramount.

Accentuating the strengths drives greater interest in your business, which in turn drives up value. Understanding risks and potential issues prior to engaging with buyers allows you to proactively address them before it’s too late, preventing value erosion or, worse, deal failure.

3. Provides Estimated Market Value And What Drives Enterprise Value For Your Business

A Strategic Assessment identifies M&A trends in your industry – providing you with a better chance of successfully navigating your transaction process.

Understanding what other sellers did to maximize or erode value, such as ‘shoring up key management gaps’ or ‘diversifying revenue streams’, can play a pivotal role in helping you understand how capital investors will perceive value for your business.

4. Affords The Opportunity To Address Shortfalls Before A Transaction

In many cases, PMCF’s bankers identify discrepancies that can be mitigated in the near term. Often, a Strategic Assessment is delivered up to 36 months prior to a transaction, providing ample time to assess and counteract potential shortfalls and position the business to enhance value.

5. Helps Align Corporate Strategy With Organizational, Tax And Wealth Transfer Planning

A Strategic Assessment addresses potential enhancements or shortfalls in your business before you approach the market to sell and helps to align your strategy and priorities to maximize your transaction outcome.

Additionally, PMCF’s affiliated relationship with Plante Moran, one of the nation’s largest audit, tax, consulting, and wealth management firms, is integral to our Strategic Assessment process. Plante Moran is able to support significant aspects of your deal, including tax planning, financial forecasting, and wealth management, allowing a tailored approach to your transaction.

Plante Moran Wealth Management often coordinates with PMCF to support clients’ estate planning and personal wealth planning. Based on your future liquidity event, the Wealth Management team understands the complexities of the deal and are experts at analyzing a liquidity event and its impact on your financial future.

6. Promotes A Higher Likelihood Of A Smooth Due Diligence Process And Deal Success

The M&A process is often complex. A Strategic Assessment completed prior to commencing a sale transaction can expedite the buyers’ review process and mitigate potential concerns that might arise during buy-side due diligence.

Strategic Assessment: A Forward-Thinking Approach

The strategic assessment performed by experienced investment bankers at PMCF provides a multitude of benefits:

- Optimize the transaction value

- Increase the probability of a successful transaction

- Reduce the time and complexity of the process

Proactive is better than reactive, especially in M&A transactions, which is why the Strategic Assessment is so important.

If you are considering starting your exit planning process, PMCF offers a complimentary Strategic Assessment.

Think of it as our investment in the relationship and our commitment to securing the best possible outcome for you and your business.

Interested In Learning More?

Authors

More Articles

PMCF’s 2024 M&A Outlook – 5 Factors That Could Impact the Middle Market

While the M&A market underperformed in 2023 amidst continued macroeconomic headwinds in the form of geopolitical tensions, rising interest rates, and fears of an economic recession, the latter half of the year showed signs of resilience as M&A activity began to stabilize. Looking ahead to 2024, multiple factors contribute to an optimistic outlook across industry…

Merger & Acquisition Considerations in the Background Screening Industry

Originally prepared for and published by PBSA in the Sept-Oct 2023 edition of the Journal. Read the full issue here: https://thepbsa.org/resources/publications/ Merger and Acquisition (M&A) transactions are some of the most transformative events any organization will experience. Whether you are contemplating acquiring another business to accelerate your growth, or think the time may be…

How Technology Can Make or Break Your Acquisition Strategy in 2023 with Matt Rupprecht

PMCF Director, Matt Rupprecht, shares his thoughts with ActivateStaff CEO, Rohan Jacob, on the impact of technology when formulating a transaction strategy.

Bryan Hughes’ Article Featured in Medical Product Outsourcing Magazine: Will a Wave of Medtech Spinoffs Hurt the Supply Base?

Bryan Hughes, Managing Director and lead of PMCF’s Healthcare team, authored the Medical Product Outsourcing article “Will a Wave of Medtech Spinoffs Hurt the Supply Base?” In the publication, he shared his thoughts on whether or not the flurry of med tech spinoff transactions will create further dislocation across the supply chain in the near…

Ellen Clark Featured in Automotive News Article: EV push could spur more supplier mergers and acquisitions

Ellen Clark, Managing Director and co-lead of PMCF’s Industrials team was featured along with other industry leaders in Automotive News’ article “EV plans could ignite new supplier buyouts.” In her interview, she shared her thoughts on the opportunities suppliers have as EV programs continue to increase and provided insights into the surrounding M&A market conditions.